What will be the effect of monetary policy on delinquency rate?

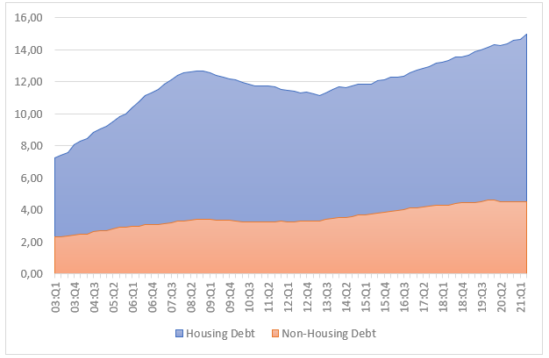

In August 2021, the Center for Microeconomic Data of the Federal Reserve Bank of New York published the quarterly report on US private debt. The figures, updated to the second quarter of 2021, show an overall increase in debt to $ 14.96 trillion (Figure 1). Mortgages remain the largest slice of debt.

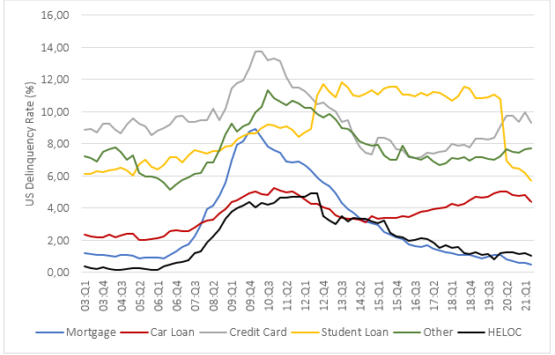

Aggregate delinquency rates have remained low and declining (Figure 2), reflecting low interest rate and an uptake in forbearances (provided by both the CARES Act and voluntarily offered by lenders), which protect borrowers’ credit records from the reporting of skipped or deferred payments.

The data shows no particular surprises. Despite the achievement of a new maximum level of private debt, the delinquency rate continues to decrease. However, it is important to bear in mind that this is happening in an extremely favourable period for debt, with very low interest rates. Private debt is certainly one of the elements that the Fed considers and that justifies prudence in monetary policy choices. In the traditional end-of-summer event in Jackson Hole, the US Central Bank stated its intention to begin tapering by the end of 2021 but did not provide information on interest rates. It will be interesting to observe the effect of any future increases in interest rates on the delinquency rate. We will continue to monitor these data as we believe that a possible reversal of delinquency rate trend could be an important risk factor given the increasing level of debt. Further updates will follow in the future.