Will platinum price ever recover?

What Is Platinum?

Platinum is a silver-white metal. It is found both in its native state and combined with other materials such as copper and nickel. It is ductile and malleable. Platinum is as resistant as gold to corrosion and tarnishing and will not oxidize in air no matter how strongly it is heated. It has the ability to conduct electricity. Together with rhodium, palladium, and other metals it forms a group of elements referred to as the platinum group metals (PGM).

Current and Future Use

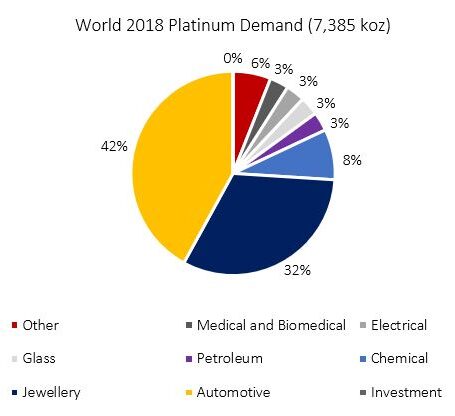

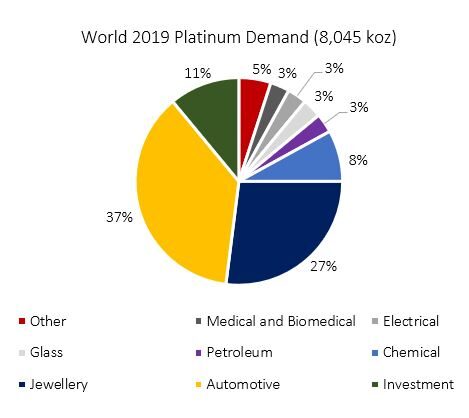

Platinum is a material used in various sectors, including the medical and pharmaceutical sectors. It is in fact very useful to produce laboratory instruments or pacemakers. It is also efficient for the neutralization of neoplasms. Due to its resistance to high temperatures and most chemical agents, it is used in the aeronautical, aerospace and chemical fields. This material finds also application to coat electrodes, electrical contacts and wires, and in airbags, in order to avoid deterioration and therefore make the cars safer. However, according to estimates by the World Platinum Investment Council, the main sectors in which platinum is used are that of jewellery (between 31% and 38% of production) and cars (between 38% and 41% of production). Platinum jewellery has achieved global premier status and strong association with love. Today China is the world’s largest market for platinum jewellery, it represents more than half of annual demand and India is a driver of growth, including increasing men’s jewellery market. In United

States, this material is the number one choice of engagement rings, while in Japan it is the favoured choice for generations of brides and grooms. The automotive sector is instead the one that sees platinum most involved. It is in fact a fundamental element used as a catalyst in diesel engines, which in the future could find an effective and durable use even in so-called hydrogen-powered fuel cell electric vehicles (FCEVs), capable of generating electricity by creating a chemical reaction between hydrogen and oxygen. These are zero-emission vehicles that, compared to the electric ones, have greater autonomy and refueling speed. Despite this and despite the fact that important companies such as Mercedes and Audi are investing to support the development of these vehicles, their growth has been slow until now, limited by the lack of infrastructure, the complexity of hydrogen conservation, the limited number of stations of supply and high costs.

Production

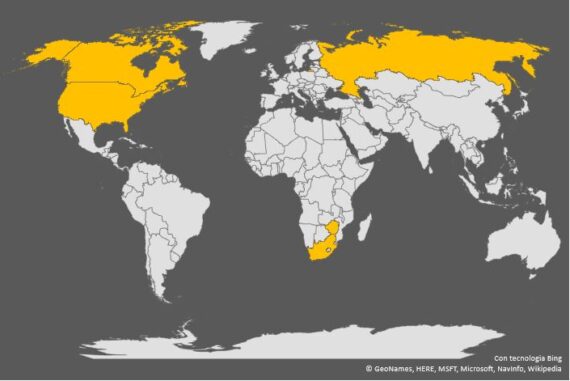

South Africa is the largest platinum producer in the world and produces about 70% (between 2010 and 2018 it has produced between 94 and 110 metric tons each year). The main companies producing this material, Anglo American Platinum, Impala and Sibanye Stillwater are indeed South African. Anglo American Platinum is the largest platinum producing company, having produced 1.29 million ounces in 2018. Russia comes in a distant second place, having produced between 23 metric tons and 21 metric tons each year between 2010 and 2018. Zimbabwe, the third largest producer, produces about half as much as Russia and it is followed by Canada and the United States, the world's fourth and fifth largest producers of platinum respectively. Their platinum production is even lower than Zimbabwe's production. In the U.S. in fact, there is only one company mining platinum.

Platinum Price Evolution

The reason for this analysis is mainly due to the price behaviour of platinum in recent years. Although platinum is a precious material like gold and silver, its price has had a very different trend, constantly decreasing between 2014 and 2018 (Figure 2). It reached very low levels going from around $ 1507 per ounce in mid-2014 to $ 827 per ounce at the end of 2018, touching a low of $777 in August 2018. The platinum price collapse is mainly a consequence of the so-called Dieselgate (or “emissions scandal”), which concerned the discovery of the falsification of emissions from cars equipped with diesel engines sold in the United States and Europe, thus allowing cars to emit pollutants that exceed the limits imposed by law. This has led to a net decrease in the demand for diesel engine machines, thus having a heavy effect also on the price of platinum, whose greater use is concentrated in the catalysts of these vehicles.

Figure 2 : platinum price graph

According to data reported by the World Platinum Investment Council, today the demand for platinum is increasing by about 9%. However, this is due to a significant increase in investment demand, which went from 0% in 2018 to 11% in 2019 and which compensates for the decrease in demand for platinum in the two sectors in which the material finds the greatest use, namely cars and jewellery, down 4% and 5% (because of a lower demand by China) respectively. Demand is therefore driven by ETF participations, which at the beginning of 2019 bought about 720,000 ounces.

To Conclude...

According to what we have seen so far, we believe that platinum can be a risky investment. It is in fact more volatile than gold and silver and not verysuitable for use as a safe-haven asset. Its demand is not widely distributed, mainly concentrated on a single sector, the automotive one, and therefore extremely dependent on the events that hit it. Regarding the future, the prospects for using platinum are almost exclusively linked to its application in hydrogen vehicles, the development of which is however still

very uncertain due to the limits previously described. The above, added to a decline in current demand in the auto and jewels sectors, raises doubts about the future potential of this material. Furthermore, if we look at production, it derives mainly from a single country, South Africa, where socio-political dynamics have an important influence on the availability of platinum. Strikes, industrial actions and power outages generate instability on the production of the material. All these elements therefore lead us to consider platinum too risky, as it is extremely concentrated both from the point of view of production and from the point of view of demand. Future forecasts regarding the world of diesel and hydrogen engines are indeed very weak and uncertain, mainly due to the enormous development and competition currently represented by electric vehicles, which could lead to a net decrease in platinum demand in the sector.