Markets do not consider fiscal policy decisions.

According to the latest data published, US inflation in November rose by 0.8%, slightly above expectations. On an annual basis, the increase was 6.8%. This is the highest level since 1982. Record also in Germany, where inflation reached 5.2%, the highest in the last thirty years. Financial markets have reacted well to the news, considering these numbers as temporary peaks that will diminish over time.

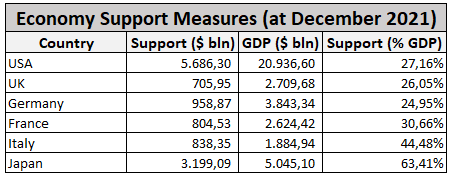

We agree that in the long term these figures represent a peak and that over time the bottlenecks in production chains will resolve, except for the energy sector which we believe will remain expensive. Despite this, however, we believe the markets are underestimating the inflation risk. They are not evaluating the effects that fiscal policy measures could have on economic growth, and consequently on inflation. In response to the spread of the pandemic, governments have launched important fiscal measures to support the economy by providing liquidity to businesses and households. The aggregate data on the measures introduced by the governments of the main world economies are presented below. The amount of support introduced by states represents a significant percentage of GDP.

In other words, financial markets are not considering an important cash flow that will reach the economy, presumably generating new jobs, especially in the infrastructural field. Therefore, we believe that an inflation scenario of over 2%, higher than the levels we have been accustomed to in recent years, is likely to persist in the medium to long term, with consequent upward pressure on prices and interest rates, which will have to adapt to new inflationary levels creating pressure on the financial markets.