Markets underestimate inflation risk by considering only monetary policy decisions.

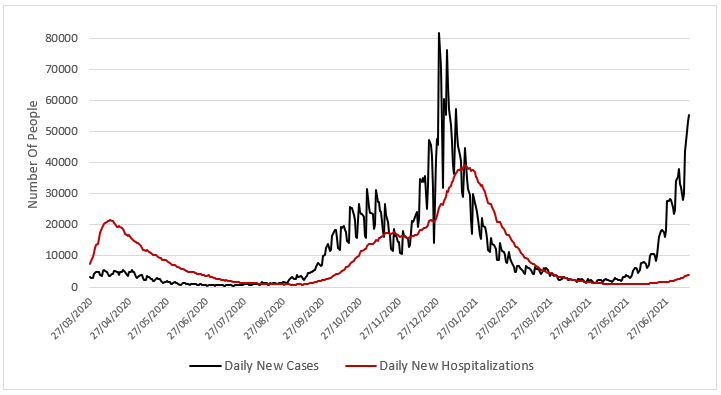

In recent months, the financial markets have focused their attention on the evolution of inflation and its effects on the economic recovery. According to the latest published data, in June 2021 inflation rate has increased. In the Euro Area it reached 1.9%, the highest level since 2018. In the United States it was around 5.4%, recording the largest increase since 2008 to date. Despite the concerns caused by the Delta variant, the outlook seems to be different compared to the past. While infections increase, fortunately, hospital admissions do not grow at the same rate. We can clearly see this from the graph below (Figure 1). It shows the UK daily trend of new cases and hospitalizations, the country most affected by the new variant.

These data, that we will continue to monitor, prove that vaccination plans are making their effects felt. This bodes well for the future and for a return to consumption that will only push prices further. All this is accentuated by a slow and complicated recovery of production chains compared to demand.

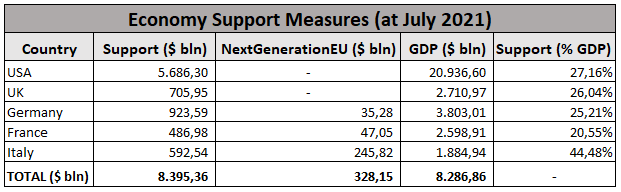

These developments are creating tensions on markets, extremely sensitive and attentive to central bank statements on monetary policy decisions. However, in our opinion, the markets are underestimating the inflation risk, not considering the effects that fiscal policy measures could have on economic growth, and consequently on prices. In response to the spread of the pandemic, governments have taken steps to launch important fiscal measures to support the economy by providing liquidity to businesses and households. The table below (Table 1) presents the aggregate data on the manoeuvres amount introduced by the governments of the main world economies. The figures show that the States support represents a significant percentage of GDP. In addition to the interventions of individual governments, the European Union has approved the so-called NextGenerationEU. It consists in a recovery plan of about €750 billion in support of the countries belonging to the group. The intervention was compared to the Marshall Plan, which amounted to €370 billion (discounted value), or half of what has been made available by the European Union. This clearly expresses the weight of the fiscal manoeuvres put in place.

The figures represent the magnitude of the interventions of some countries, but we must not forget that governments around the world have implemented manoeuvres to support the economy. From the data collected, we can estimate that the total fiscal stimulus introduced by governments worldwide is around $21,584.04 billion. This represents an incredibly significant amount, which expresses even more the extent of the interventions implemented.

Inflation growth will therefore not only depend on monetary policy decisions but also on the effects that the huge support made available by governments and the European Union will have on the entire economy. This presumably will generate new jobs, greater wealth, and greater consumption. We believe that an inflation scenario at levels well above those we have been accustomed in recent years will persist in the medium-long term, with a consequent upward pressure on prices and interest rates, which will have to adapt to the new inflationary levels, creating further pressures and tensions on the financial markets.