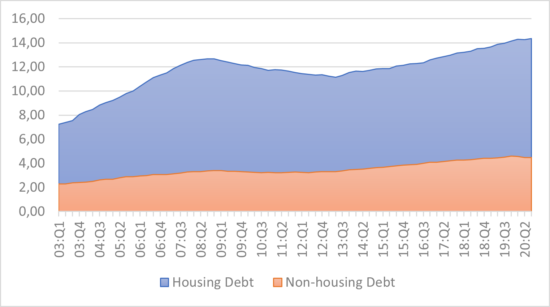

In November 2020, the Center for Microeconomic Data of the Fed of New York published the quarterly report on US private debt. The figures, updated to the third quarter of 2020, show an overall increase in debt. Mortgages remain the largest slice of debt. Mortgage debt at the end of September was $9.86 trillion, up $85 billion from the second quarter of 2020(Figure 1). The total non-housing debt grew by $15 billion, following the $86 billion decline seen during the second quarter. It remained lower than at the beginning of 2020.

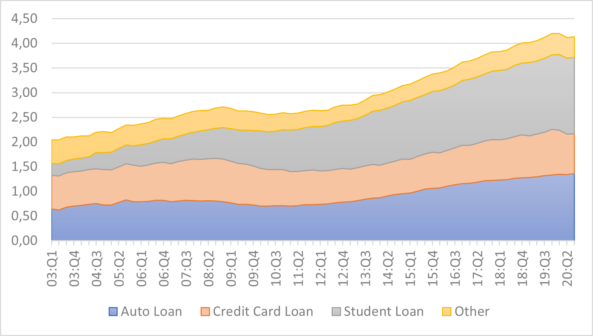

More specifically, auto loans increased by around $17 billion. Student loans grew by $9 billion, continuing to be a sore point for American families (Figure 2). Credit card debts declined by $10 billion, on the heels of a $76 billion decline in the previous quarter. This reflected continued weakness in consumer spending as well as active paydowns by cardholders.

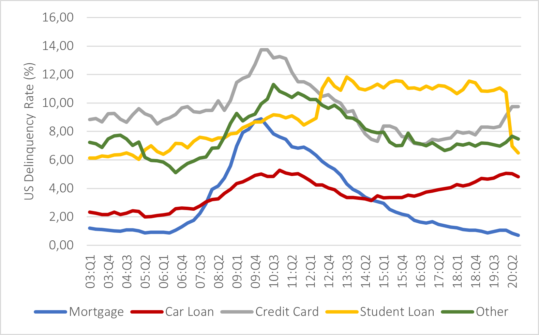

Aggregate delinquency rates have dropped markedly in the second and third quarter of 2020 (Figure 3). This is the result of an uptake in forbearances (provided by both the CARES Act and voluntarily offered by lenders), which protect borrowers’ credit records from the reporting of skipped or deferred payments. At the end of September , 3.4% of total debt was insolvent. It was down 0.2% and 1.4% compared respectively to the second quarter of 2020 and fourth quarter of 2019, before the COVID-19 hit the United States. Despite the decrease, much of the insolvent debt remains seriously delinquent. Of the $485 billion of insolvent debt, approximately $363 billion is seriously delinquent (at least 90 days late).

Overall, in the third quarter of 2020 US private debt rose by around $87 billion (0.6%) to $14.35 trillion and hit a new record high. The increase offsets the decline seen in the second quarter of 2020. Total debt is now $1.68 trillion higher than the previous peak of $12.68 trillion reached in 2008.