“Is the Phillips curve a useful descriptor of inflation dynamics?”

The Context

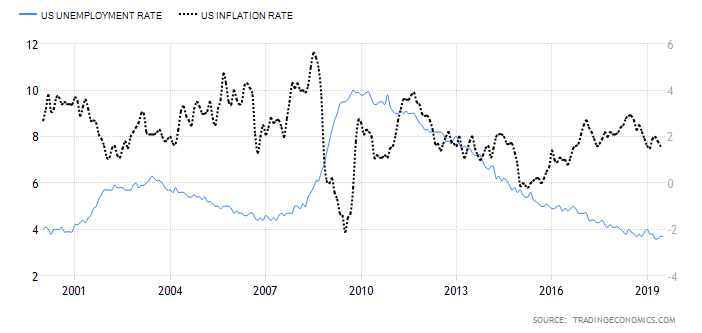

In recent years inflation in the United States, despite various interventions by the authorities, has slightly changed. The US unemployment rate is now below 4%, at a minimum level compared to the values recorded in the last decades. This should be a symptom of a healthy economy, characterized by a growth in the demand for goods and services, and consequently in prices. This is the concept at the basis of the standard economic relationship known as the Phillips curve. To date, this relationship between unemployment and inflation does not seem to exist, and this may not be surprising if we look at the past, since even historically the relationship has not always been so direct. Figure 1 graphically shows the relation between the US inflation rate and unemployment rate over the last 40 years. We can observe, for example, that in the 1990s, despite a gradual decrease in the unemployment rate, inflation remained substantially unchanged. Today, a similar situation is occurring, since in the years after 2008, even though the unemployment rate has dropped steadily from 10% to 3.7%, inflation has slightly changed, currently recording a value lower than the target of 2%. Why is this happening? We are trying to find answers to this phenomenon.

Limited Wage Gains

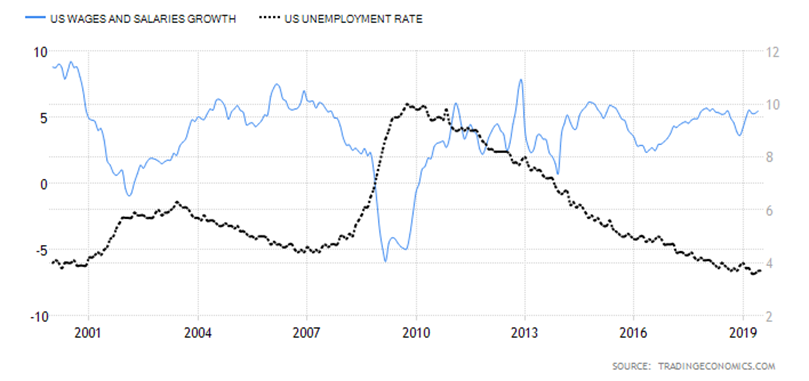

Despite the absence of a clear relationship between the unemployment rate and inflation, such a low unemployment should have an inflationary effect. However, employment is not enough to justify a rise in prices. The fundamental element is the employment quality. Looking at Figure 2 it is possible to note that the increase in wages is not directly related to the decrease in unemployment. After 2008 in the United States, despite its constant decrease, wages have had contained growth rates, especially in recent years. This is because they are compressed by an extremely fast globalization, poorly managed at a regulatory level. All this leads to a deflationary effect since people, because of low wages, spend less thus causing a decrease in demand and prices.

Low Interest Rate

Lower interest rates produce a double effect on inflation. On one hand they generate inflation, pushing debt and consequently spending and investments, while on the other they contribute to its reduction. In fact, they have a deflationary effect both in the short term, since the wealth held by people has lower returns, consequently reducing the additional amount of capital to be spent, and in the medium-long term, when the accumulated debt must be repaid, thus generating lower future expenses.

“Digital Price Index (DPI): a new measure of inflation, derived considering millions of online transactions collected by Adobe Analytics.”

“E-commerce represents a growing share of the retail market. In 2018 in United States it took a 14.3% share of total retail sales, up from 13% in 2017 and 11.6% in 2016.”

Technological progress

In recent years, the development of technology and the Internet has led to rapid globalization, generating ever-increasing competitiveness. Today, through the network, not only existing brands are competing, but also new offers. If a new brand a few years ago, to enter the market and be known globally, would have had to spend millions on advertising, store management and staff, today it is no longer the case. The Internet allows for even greater visibility at very low costs. A few decades ago, we shopped at malls, which typically had around 80 stores. Now we shop on Amazon.com, which offers more than 250 million of products and stores.

Online competition concerns not only products, but also services. For instance, companies such as Uber are putting pressure on car production and prices since this service means fewer people who want or need cars. Today it is also possible, through simple apps, to get in touch with consultants (for example in the marketing or site creation fields) in every part of the world, able to provide performance on par with decidedly lower prices.

This situation of total globalization therefore leads professionals and companies to adapt to be competitive. Not only online competition, but also all other new technologies have effects. While they help us make everyday life easier, on the other hand they replace people. Companies are increasingly using robots and algorithms, leading to a lower recognition of professional figures, thus reducing their pricing power.

It is therefore immediate to understand how the growing technological development, the low-cost competition and the possibility of having so much stuff in one place allow to easily compare products and to find alternatives, generating pressure on prices and thus having a deflationary effect.

Demographic transitions

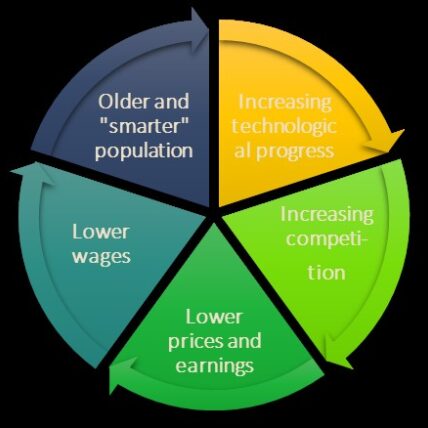

Lower prices result in lower earnings. This translates into lower wages, which generate a demographic effect. The births are reduced, both for the costs related to maintenance and for the limited future job prospects, thus leading to the aging of the population. Older people spend less, reducing demand and not allowing prices to rise. From 1990 to 2018 the average age grew from 32.9 to 38.2.

Figure 3: Vicious circle as projection for the future

To Conclude...

Looking to the future, it is difficult to expect a further drop in the unemployment rate, as it is already at historical lows. The only solution could be an increase in wages, although today it seems to be very unlikely. Over time technology and the Internet, if not regulated with suitable measures, will develop more and more, also thanks to the fact that the population, even if older, will always be “smarter”. The projection (Figure 3) is therefore that of a society that will increasingly make use of these tools, thus leading to a reality in which technology will progressively replace man and in which competition on a global level will be increasingly fierce, causing a lowering of prices and generating an ever greater cut in costs through the reduction of wages. This in turn will cause a decrease in the rate of population growth and therefore lower demand, thus leading to a deflationary effect.

Moreover, it is also relevant to add that because of the growing role of digital economy and its impact on prices, in recent years both universities and research companies are trying to create new inflation indicators capable of assessing its weight, such as the Digital Price Index (DPI). In conclusion, according to what has been stated so far, and considering that central banks do not seem to have great means to intervene, for the future we see a greater deflationary than inflationary pressure, whose simplest solution could be represented by new regulatory and fiscal measures, rather than monetary policies.